New Insurance Fraud Technology: Actionable Intelligence to Help Law Enforcement

Workers’ compensation fraud is under attack, with new technology making it easier for law enforcement agencies to find and stop those trying to manipulate the system.

To gain more immediate insight into this $80-billion-dollar problem, law enforcement agencies and insurance carriers now have huge volumes of data at their disposal - claims information, national and state records, social media and third party details on relationships, criminal records and address changes. With that comes the challenge of interpreting the massive amounts of information in a way that’s actionable.

As fraudsters become smarter and use sophisticated schemes more effectively, it’s essential law enforcement agencies leverage new technologies to stay a step ahead and spot today’s highly complex fraud activities.

Actionable, real-time intelligence

Industry research shows organized criminal enterprises target specific communities and will go undetected for an average of 5 to 10 years if law enforcement agencies do not know what to look for and how to stop it.

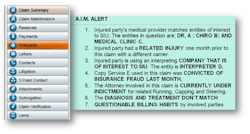

Insurance carriers like ICW Group are at the forefront of developing sophisticated anti-fraud visualization tools such as its Analysis Investigation Module (A.I.M.) to combat work comp fraud, even before it begins. Advanced analytics visualization makes fraud detection far more accurate and effective. Analytics also provide the agility to keep up with the rapid changes inherent in today’s complex fraud schemes.

Many of the convicted and indicted parties involved in organized insurance fraud will continue the scheme under new names with a slightly modified M.O. To avoid a “new” group from operating or continuing in our communities, carriers must be diligent in continuously checking various data sets from the “old” organization against new data coming in. It’s imperative that additional data and intelligence layers are added that include the scheme itself.

By closely monitoring the behavior of the criminals, and observing the patterns of the victims, we can predict what new trend is developing and put a stop to it before additional harm occurs. In turn, sophisticated carriers proactively notify law enforcement when concerning patterns develop, so they can take action and protect their citizens.

For example, perhaps there’s a long line of patients overflowing from a medical clinic that extends down the street. Chances are the individuals are not there to seek a stellar medical professional. First, we need to determine if they are there to seek treatment for an ailment or if they are there to meet a requirement due to unlawful capping, running and steering. A call to an insurance Special Investigation Unit representative can guide you in the right direction with scenarios like this.

Other notable examples of advanced analytic visualization capabilities also include:

- The billing activity in a certain ZIP code that doesn’t match the surrounding ZIP codes. If we’re looking at all the ZIP codes in a certain area and suddenly there’s an outlier, the system will automatically show us that, versus manually looking and trying to compare data points.

- There’s an injured worker that had multiple injuries to the same body part, yet he’s saying that this is the first time it’s happened. Automatically, the system reveals that data, and the insurer can start guiding the investigation accordingly.

- A provider billing code that has been billed for a while and then suddenly changes to a different code. Perhaps it’s to stay under the radar by remaining below a certain billing threshold. Or maybe it’s a proven billing strategy used throughout the organized crime ring. Big data analytics enables insurers to look at everything, and lets the data speak to us.

The visualization of datasets groups vast amounts of information in a clear, concise and meaningful way. Trends and patterns emerge that make it easier for law enforcement to produce evidence to prosecute criminal activity.

Partnering to prevent fraud

Forward thinking insurance carriers like ICW Group have the tools and data that can help predict and prevent this multi-billion-dollar scheme from hurting our communities. Working in partnership, carriers have the ability to assist law enforcement agencies if they do not have the analytic tools necessary to uncover or visualize the schemes. We frequently provide law enforcement with large charts to assist in visualizing the complexities of any given criminal ring we are working on.

Like most carriers, we receive tens of thousands of documents every month that contain real-time intelligence. If suspected fraud is discovered, we are mandated to report our findings to law enforcement. Regulations in most states also allows for law enforcement to request the evidence they need directly from an insurance carrier to assist in a successful prosecution (for example, California Insurance Code section 1877.3).

Stopping fraud in its tracks

Carriers with strong Special Investigation teams can often answer questions that patrol or detectives may have regarding patterns they are seeing, particularly related to fraud in the healthcare system. Without today’s increasingly sophisticated technology, many of these requests would be impossible to fulfill, or at least would fall short of assisting law enforcement in a timely manner. Now, tasks that would have taken months, take just days or hours. It’s a huge savings in manpower and investment – and it’s more far accurate.

To remain at the forefront of detecting fraud, big data technology must be continually updated with new industry trends, organized criminal behavior, laws and new analytic capabilities. Thankfully today, more and more sophisticated tools are in place to effectively combat this trend. By using big data advanced analytics, we have significantly strengthened our weapon in the fight against fraud.

About the AuthorMike Bender is the assistant vice president and head of ICW Group's Special Investigation Team. He has more than 30 years of industry experience and is veteran of the Los Angeles Police Department.

Email:[email protected]

Address: 15025 Innovation Drive, San Diego, CA 92128

Mike Bender | Assistant vice president

Mike Bender is the assistant vice president and head of ICW Group's Special Investigation Team. He has more than 30 years of industry experience and is veteran of the Los Angeles Police Department.